This article analyzes the true costs of importing cooler bags from Asia to the US and EU. We break down product pricing, freight, duties, and hidden fees to help wholesalers and distributors make informed purchasing decisions.

Cost Analysis of Importing Cooler Bags from Asia to the EU and US

Importing cooler bags from Asia1 involves product cost, shipping, taxes, and compliance. Total landed cost per unit ranges from $3.50 to $5.00 depending on method and destination.

Knowing your total cost ensures healthy margins and avoids import surprises.

1. Product Cost (FOB Asia)

Cooler bags from Asia are generally quoted as FOB (Free On Board), meaning the seller delivers goods to the port and the buyer covers sea freight onward.

Understanding FOB Pricing for Cooler Bags2

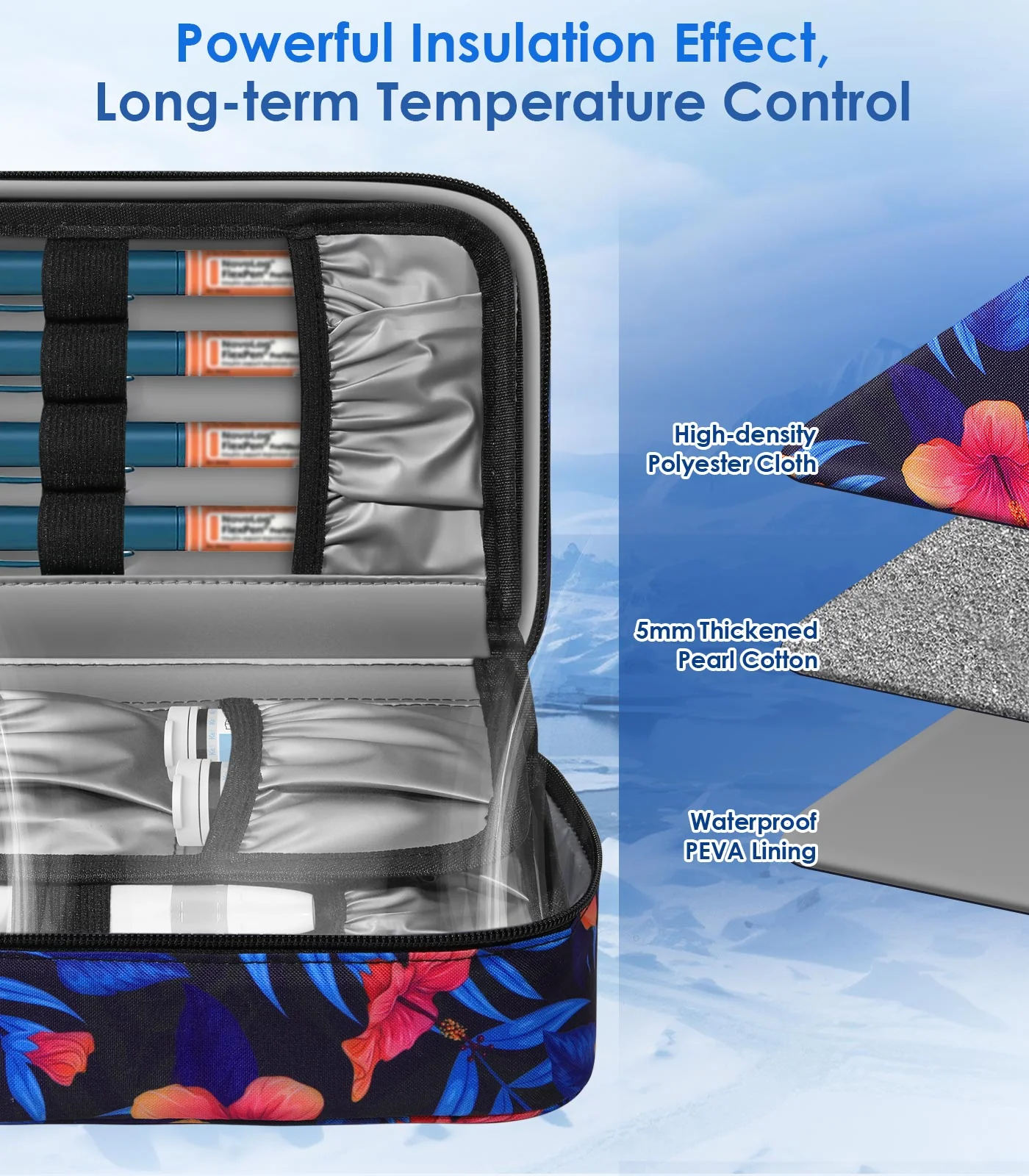

Most suppliers in China, Vietnam, and India quote FOB prices that vary by size, insulation quality, material, and branding.

Typical FOB Cooler Bag Price Ranges

| Bag Type | Estimated FOB Price (USD) |

|---|---|

| Small lunch bag (generic) | $1.80 – $3.00 |

| Medium retail-grade cooler | $3.00 – $6.00 |

| Premium branded cooler | $7.00 – $15.00 |

Buyers should consider the minimum order quantity (MOQ), which often starts at 1,000–3,000 units. Price breaks typically occur at 5,000+ units.

Choose a supplier with strong production capabilities and product testing to ensure consistent quality across shipments.

2. Freight and Logistics3

Freight is the second-largest cost factor. Sea freight is the most economical method, especially for large bulk orders.

Sea vs Air Freight4: Choosing the Right Method

Sea freight from Asia to the EU or US varies based on container size and destination port. Air freight is faster but adds significant cost.

Freight Comparison Table

| Item | Sea Freight (per unit) | Air Freight (per unit) |

|---|---|---|

| Container cost (20ft) | $2,000 – $4,000 | N/A |

| Units per container (avg) | 8,000 – 10,000 | N/A |

| Unit cost estimate | $0.25 – $0.50 | $2 – $5 |

| Port/Customs fees | $0.10 – $0.30 | $0.10 – $0.30 |

| Insurance (optional) | $0.10 – $0.30 | $0.10 – $0.30 |

Plan ahead. Ocean freight requires 3–6 weeks lead time, but it greatly reduces per-unit shipping costs. Air is suitable only for urgent, small-volume deliveries.

3. Import Duties and Taxes5

Import tariffs vary by country and classification code. Classification errors can cause rejections or penalties.

Duty Rates and VAT Differences6: US vs EU

US Duty and Tariff Summary

| Factor | Amount |

|---|---|

| Base duty rate (HTSUS) | 3.4% – 7% |

| Section 301 (China goods) | Up to 25% additional duty |

| Total duty range | 7% – 32% |

EU Duty and VAT Summary

| Factor | Amount |

|---|---|

| Base duty rate (from Asia) | 3% – 10% |

| VAT (Germany example) | 19% |

| VAT (France example) | 20% |

VAT is usually reclaimable for EU-registered businesses. For smaller batches under €150, only VAT applies.

4. Other Hidden Costs7

Beyond shipping and duties, other charges add to the landed cost. These are often overlooked but can affect overall profitability.

Planning for Inspection, Clearance, and Final Delivery

Buyers should budget for quality checks, customs brokerage, and last-mile delivery.

Additional Costs Table

| Cost Item | Per Unit Cost (Estimate) |

|---|---|

| Quality inspection | $0.04 – $0.08 |

| Customs broker fees | $0.10 – $0.20 |

| Clearance/document handling | $50 – $200 per shipment |

| Last-mile/warehousing | $0.10 – $1.00 |

Quality inspections help avoid expensive recalls. Customs brokers streamline import declarations and reduce errors.

5. Sample Cost Breakdown8 (Per Unit)

Using a common scenario: 5,000 units of cooler bags from China shipped by sea to the US and EU.

Breakdown Based on Current Mid-2025 Rates

| Cost Item | US (No 301) | US (With 301) | EU |

|---|---|---|---|

| Product (FOB) | $3.00 | $3.00 | $3.00 |

| Freight & Fees | $0.40 | $0.40 | $0.40 |

| Import Duty | $0.21 (7%) | $0.21 | $0.21 |

| Section 301 | – | $0.75 (25%) | – |

| VAT | – | – | $0.62 |

| Broker/Other Fees | $0.10 | $0.10 | $0.10 |

| Total | $3.71 | $4.46 | $4.33 |

Use these figures to calculate resale margins and adjust retail prices accordingly.

6. Key Compliance Tips9

Proper compliance reduces risk of detention and extra charges.

Documentation and Tariff Codes10 Matter

Use accurate HS/HTS codes for your product type:

- HS Code 4202.92.08: Manmade fiber cooler bags.

- For some insulated food bags: 4202.92.30.

Compliance Checklist

| Task | Recommendation |

|---|---|

| Confirm tariff code | With customs broker |

| Pre-clearance documents | Bill of Lading, Invoice, CO |

| Consider third-party inspection | Before loading |

| Use DDP/DDU terms wisely | Clarify incoterms upfront |

Incorrect codes or missing documents may cause reclassification, delays, or fines.

Conclusion

Importing cooler bags from Asia requires careful cost analysis. Product cost, freight, and duties make up most of the landed cost. EU buyers must account for VAT, while US importers should watch for China-specific tariffs.

My experience suggests working with reliable suppliers and experienced freight forwarders can help control costs and avoid delays. Always request updated quotes and classification reviews before placing bulk orders.

Do you have questions about importing cooler bags or want custom product quotes? Share your experience in the comments below or reach out to us.

-

Explore this link to understand the comprehensive costs involved in importing cooler bags, ensuring informed purchasing decisions. ↩

-

Learn about FOB pricing to make better decisions when sourcing cooler bags from suppliers. ↩

-

Discover effective strategies for managing freight and logistics to optimize your import process. ↩

-

This resource will help you weigh the benefits and drawbacks of each shipping method for your imports. ↩

-

Understanding duties and taxes is crucial for budgeting your import costs effectively. ↩

-

Explore this link to grasp the differences in duty rates and VAT, which can significantly impact your costs. ↩

-

Uncover the often-overlooked costs that can affect your overall profitability when importing. ↩

-

Review this breakdown to better understand the financial aspects of importing cooler bags. ↩

-

Explore essential compliance tips to avoid delays and extra charges during the import process. ↩

-

Understanding tariff codes is vital for ensuring compliance and avoiding penalties. ↩